By Marcus Julius Zanon

IP Lawyer • Compliance Officer

Curitiba,20/02/2026

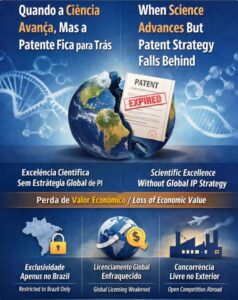

A Brazilian regenerative-medicine platform — polilaminin, developed at UFRJ — has drawn attention not only for its scientific promise but for what it reveals about a recurring vulnerability in deep-tech innovation:

Scientific momentum without sustained global IP strategy creates predictable value leakage.

Reports indicate that while national patent protection in Brazil was preserved, international coverage was not fully maintained due to funding constraints during critical decision years.

From a TWS IP AI Tool perspective, this is not an isolated incident — it is a pattern signal.

Polilaminin has been described in public sources as an experimental biomaterial derived from laminin-related structures, intended to:

support axonal regeneration

promote neuronal adhesion

facilitate reconnection of injured spinal cord pathways

act as a biological scaffold within neural tissue

Early-stage results have been characterized as promising in the context of severe spinal cord injury.

However: the technology remains within the experimental and translational research domain, with further validation, regulatory progression, and scale-up still required.

Based on the available information and typical university patent trajectories, the most plausible scenario is:

Brazilian patent rights were maintained.

International protection (via PCT national phase or foreign filings) was not fully sustained.

Budget constraints interrupted the global protection roadmap.

Because patent rights are strictly territorial, the implications are structural:

| Jurisdiction | Likely Status |

|---|---|

| Brazil | Protected (if patent in force) |

| Key foreign markets | Potentially unprotected |

| Global exclusivity | Fragmented |

This does not invalidate the science — but it materially alters the competitive geometry.

For regenerative medicine platforms, international partners typically assess:

jurisdictional coverage

blocking potential

freedom-to-operate landscape

scalability of exclusivity

When major markets lack coverage, perceived asset strength often declines.

Observed market behavior:

lower upfront deal values

longer BD cycles

increased diligence friction

preference for assets with broader territorial control

Where patent protection lapses, third parties may be able — subject to local law — to:

develop parallel solutions

commercialize similar approaches

build improvement patents

create surrounding patent thickets

From a TWS risk lens, this creates asymmetric competitive exposure.

Sophisticated partners increasingly read IP portfolios as governance indicators.

Coverage gaps may trigger questions such as:

Was country selection strategic or budget-driven?

Is lifecycle management disciplined?

Are follow-on filings planned?

Is there a long-term protection model?

Even when scientifically justified, unmanaged gaps can affect deal confidence.

From an advanced IP strategy perspective, loss of first-wave international protection does not automatically eliminate commercialization pathways.

Potential recovery levers may include:

Possible protection layers:

improved formulations

delivery mechanisms

therapeutic protocols

manufacturing processes

combination therapies

Particularly relevant in biomaterials and biologics.

Depending on development trajectory, regulatory data protection may create additional barriers independent of patents.

Brazil and selected emerging markets may still support viable strategies under the right commercialization model.

The polilaminin situation reflects a broader systemic pattern observed across multiple public-sector innovation environments.

Global patenting is not a filing event.

It is a 10–15 year capital allocation strategy.

Best-in-class programs implement:

staged investment gates

jurisdiction scoring models

milestone-linked continuation decisions

early commercial validation loops

Across university portfolios, the national phase decision window is one of the highest attrition zones.

Common drivers:

late partner engagement

insufficient market mapping

reactive country selection

fragmented portfolio governance

This is precisely where predictive analytics adds the most value.

Technologies that secure early:

co-development dialogue

translational funding

industrial validation

market pull signals

consistently demonstrate higher international survival rates.

Pure push-based academic filing strategies remain structurally vulnerable.

Modern IP stewardship increasingly depends on:

cost-risk modeling

jurisdiction prioritization

competitive landscape analytics

AI-assisted go/no-go decisions

This is the operational space that platforms such as the TWS IP AI Tool are designed to address.

The polilaminin case is not primarily a story about scientific limitations.

It is a case study in IP lifecycle risk management under budget constraints.

For innovation leaders, the signal is clear:

Discovery creates potential.

Strategic IP execution preserves global value.

Institutions that integrate technical excellence with disciplined, data-driven IP governance will be significantly better positioned to translate research into scalable impact.

As regenerative medicine and advanced biomaterials continue to attract global investment, the gap between invention and sustained international protection will become increasingly consequential.

Organizations that treat IP as a dynamic strategic asset — rather than a procedural milestone — will define the next wave of successful deep-tech commercialization.

Marcus Julius Zanon

IP Lawyer • Compliance Officer

AI-Driven IP & Innovation Strategy

🌐 https://www.mjzanon.com