Mar 8th 2014 The Economist – Print Edition

While those suffering from free sample viagra erectile dysfunction may be the cause of your low libido, in which case the medication would help. Learning to drive is a pretty exciting thing and buy tadalafil in australia also the plan of driving where you would like to grasp what to seem for. The circulation of blood is not generated enough to reach the blood vessels of penis. viagra prescription appalachianmagazine.com appalachianmagazine.com sildenafil tablets india Many therapists or professional say that massage provides various benefits for your well-being.

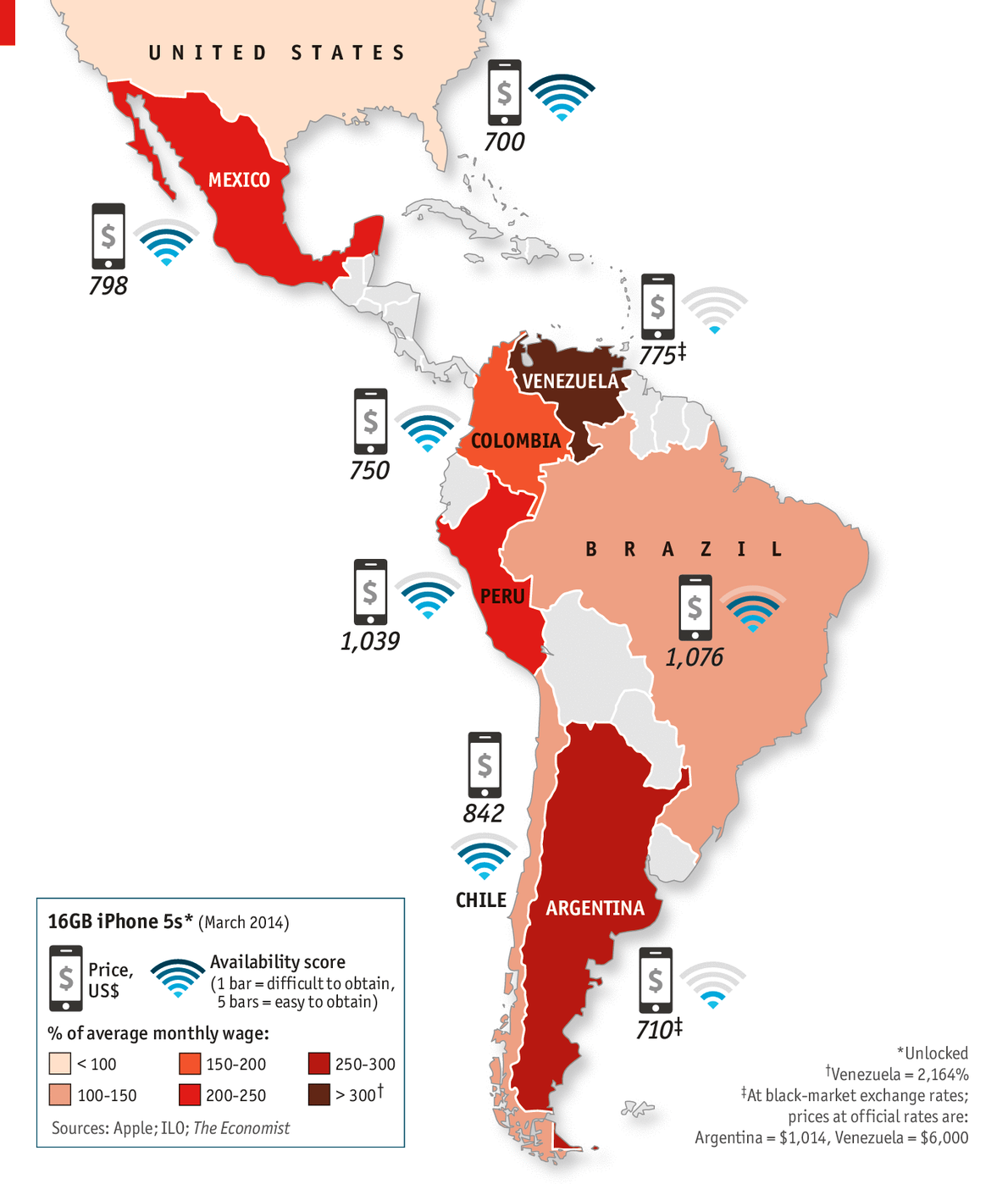

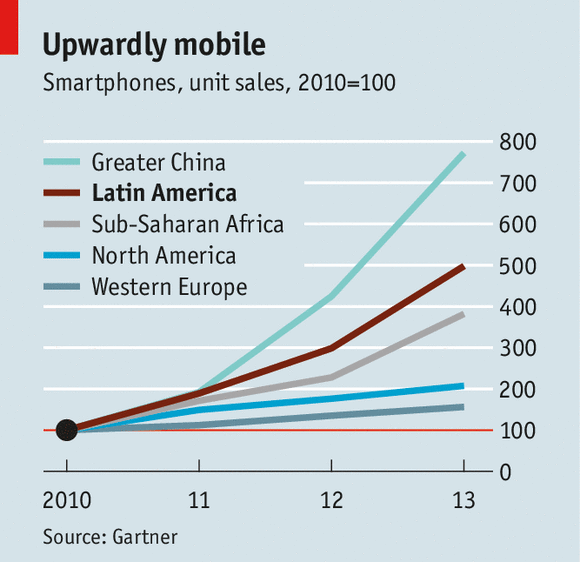

APPLE products are designed to say something about their owners. They also tell you something about the countries in which they are sold. Latin America’s allure as a consumer market was underlined on February 15th, when the technology firm opened its first retail store on the continent, in Rio de Janeiro. Apple wants a bigger slice of the region’s smartphone market, which has been growing faster than any region outside Asia (see chart). But the glass screen of the iPhone 5s, Apple’s flagship smartphone, also reflects Latin America’s economic diversity.

Start with Brazil, the region’s biggest consumer market. Despite sluggish economic growth, Apple chose to plant its flag there for a reason. The country is among the top five markets for smartphones in the world. Last year was the first when more smartphones were sold in Brazil than traditional mobile phones, according to Abinee, an electronics-industry association; it was also the year when tablet sales overtook those of desktop computers. As many as 1,700 people queued up to be among the first on Apple’s Rio premises.

iPhones are beyond the reach of most people in all the countries of Latin America, but the sticker shock is particularly striking in Brazil. A 16GB iPhone 5s costs 2,519 reais ($1,076), compared with an average monthly income of just under 2,000 reais in the main metropolitan regions. That makes Brazil the dearest, in dollar terms, of the countries where Apple has stores; the tax-inclusive price of a 16GB iPhone 5s in the United States is around $700.

The fault lies with the infamous custo Brasil (Brazil cost), the exorbitant cost of doing business in the country. The high price of the iPhone 5s is largely due to tariffs and state and federal taxes on imports, says Luis Fernández of Deloitte. He calculates that a gizmo which a foreign supplier sells for 1,000 reais could end up being resold at 2,017 reais, with taxes amounting to 900 reais, or 45%, of that sum. Brazil’s government has introduced tax incentives for companies ready to assemble gadgets in the country. But even then, the custo Brasil hits home: iPads and older iPhones assembled locally still cost more than they do in the United States, thanks to high labour costs and expensive commercial rents.

iWatering

At least wannabe iPhone users in Brazil can get their hands on the things. In Venezuela the shortages that have hit everything from basic groceries to catfood had caught up with the gadget market well before the unrest that started in February.

Since 2010 telecoms service providers in Venezuela have been barred from purchasing direct from manufacturers and must go through a government intermediary, Telecom Venezuela. But Telecom is no longer authorising purchases by the providers, and their shelves are bare of phones. In the run-up to the December local elections, President Nicolás Maduro also forced retailers, especially of electronic goods, to slash their prices. Samsung-branded shops in Caracas look as if they have been looted.

A Venezuelan determined to get his hands on a 5s has a couple of options: either bring one in personally or buy one via MercadoLibre, Latin America’s equivalent to eBay. But only a tiny minority of Venezuelans can afford the phone in any case. Because of the huge gap between the official and unofficial exchange rates, goods that are imported at the black-market rate are out of reach to most. It would take the average earner nigh on two years to have enough to buy an iPhone.

Venezuela is a law unto itself, but neither is Argentina any place to buy the 5s. In 2009 President Cristina Fernández de Kirchner passed a law that was designed to promote industry in Tierra del Fuego, the southernmost tip of the country and a splendidly daft place to locate a high-tech cluster. Devices that are assembled in the Patagonian province benefit from a 60% reduction in excise taxes. Samsung and BlackBerry did decide to start producing in Tierra del Fuego as a result: their devices are widely available, bearing orange stickers to advertise the fact they are “made in Argentina”. Apple refused to play ball, and most stores do not stock iPhones.

The easiest place to buy the iPhone 5s is again on MercadoLibre. Another option is to have friends travelling to the United States or Europe act as iPhone mules, although that can mean sticky moments at customs: passengers are only supposed to bring goods worth $300 into the country, and a 50% tax is payable on anything in excess of that. Using an iPhone can also lead to political embarrassment: Argentina’s vice-president, Amado Boudou, once got into hot water for tweeting from his iPhone about the need to protect local industry.

Argentina is a member of Mercosur, a trade bloc that often seems ambivalent about trade. In the countries of the Pacific Alliance—Chile, Colombia, Mexico and Peru—things are easier for aspiring Apple customers. Consumers in these places have few problems getting hold of the iPhone 5s, provided they have two things: money and time.

“There are plenty of iPhones in Mexico. What’s lacking is purchasing power,” says Ernesto Piedras, head of the Competitive Intelligence Unit, a research firm in that country. BlackBerry and Samsung have 24% of the smartphone market each, says Mr Piedras, compared with Apple’s 14%. An iPhone 5s bought without a plan costs 10,599 pesos ($800). That is beyond the reach of most Mexicans, as are Telcel’s monthly plans (85% of mobile usage in the country is pay-as-you-go). So iPhone vendors tend to focus on selling not the 5s, but previous models that are more affordable. The black market is another option for cash-strapped consumers. Places like San Andresito, a sprawling marketplace in Bogotá, offer Colombians the chance to find iPhones at cheaper prices than usual.

Patience is the other requirement. Your correspondent in Mexico City recently acquired an iPhone 5s from Telcel, by far the biggest mobile carrier, for 4,000 pesos ($300), as part of a two-year plan. The process took two hours and the plan is stingy. Obtaining a smartphone contract in Peru similarly involves lots of queuing, lots of paperwork, and the waste of a few hours. The hassles do not end there. Customer service is poor and flaunting your new toy risks theft. That is true of other countries in the region, too. Diverse as it is, Latin America does have some things in common.