Breaking News: Valuable Trademark Insights from Trademark Gazette 2821 of January 28, 2025. Just Published!

Comprehensive Report on Brazil’s Intellectual Property Publications (RPI 2821)

Date: January 28, 2025

Prepared by: M. J. Zanon, Brazilian IP Attorney-At-Law

Contact: [email protected]

Abstract

This report offers a comprehensive analysis of Brazil’s intellectual property landscape as documented in RPI 2821. Powered by the advanced TWS AI-Powered IP Tool, it examines trademarks, industrial designs, technology contracts, and international agreements. The analysis identifies key trends such as Brazil’s growing emphasis on sustainable innovations, the expansion of the digital economy, and the rising engagement of multinational firms in strategic IP activities. Utilizing predictive analytics and data-driven insights, the report provides actionable recommendations to optimize IP management, foster technological advancement, and enhance Brazil’s competitiveness in the global innovation ecosystem.

Index

- Introduction

- Objective and Scope

- Methodology and Tools

- Key Insights

- High Opposition Rates

- Foreign Filings and Cross-Border Trends

- Domestic and Regional IP Dynamics

- Trademark Filings

- By State: Activity Highlights

- By Nice Class: Dominant and Emerging Classes

- Top Titleholders

- Filing Leaders and Key Sectors

- Despacho Analysis

- Key Occurrences and Strategic Observations

- Regional IP Activity

- São Paulo’s Dominance

- Emerging States and Opportunities

- Strategic Recommendations

- Streamlining Filing Processes

- Enhancing IP Compliance

- Promoting Regional IP Engagement

- Visual Insights

- Graphical Representations of State and Class Activity

- Despacho Trends and Regional Dynamics

- Conclusion

- Summary of Findings

- Future Outlook for Brazil’s IP Landscape

- Contact Information

- How to Connect and Access Full Resources

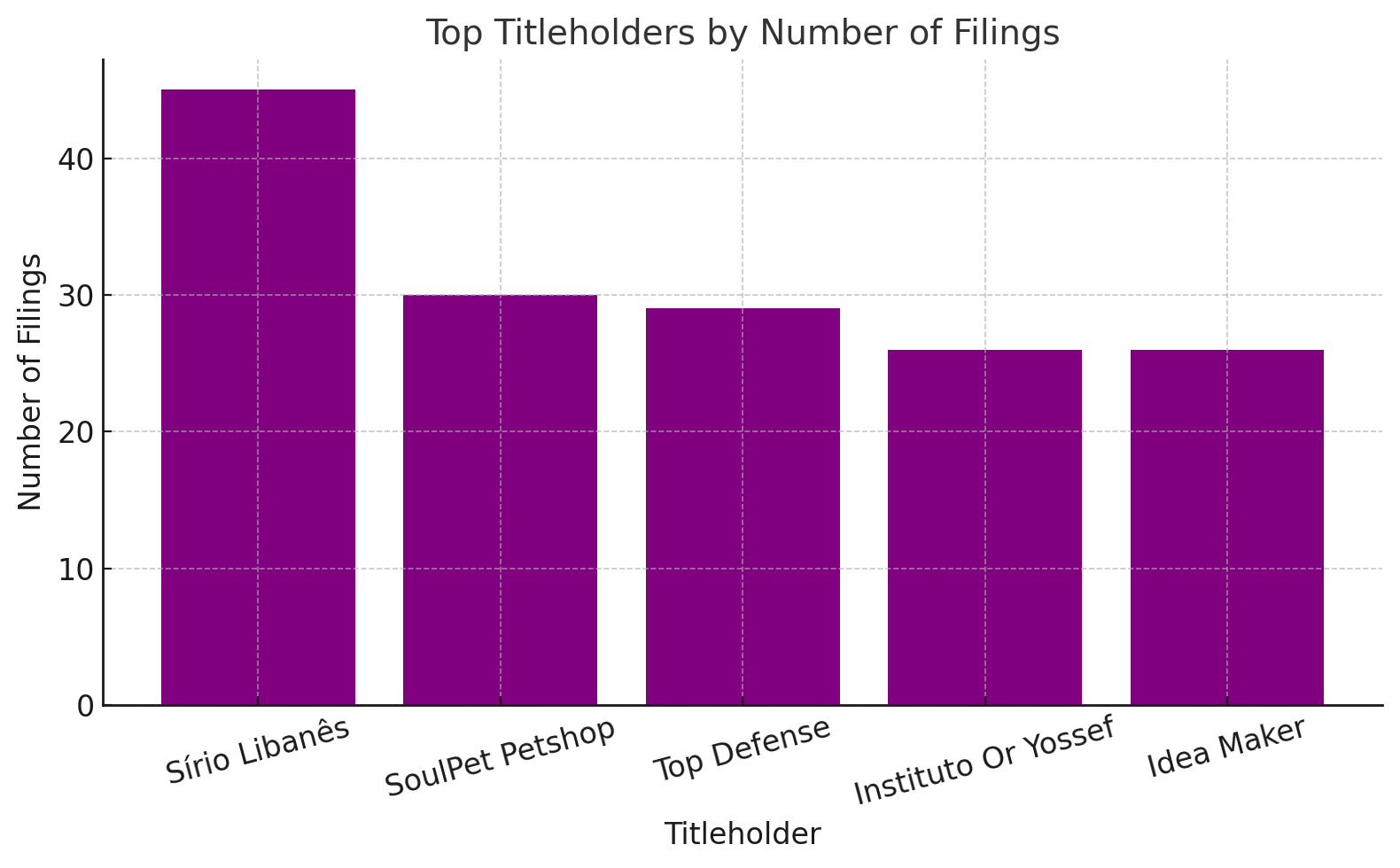

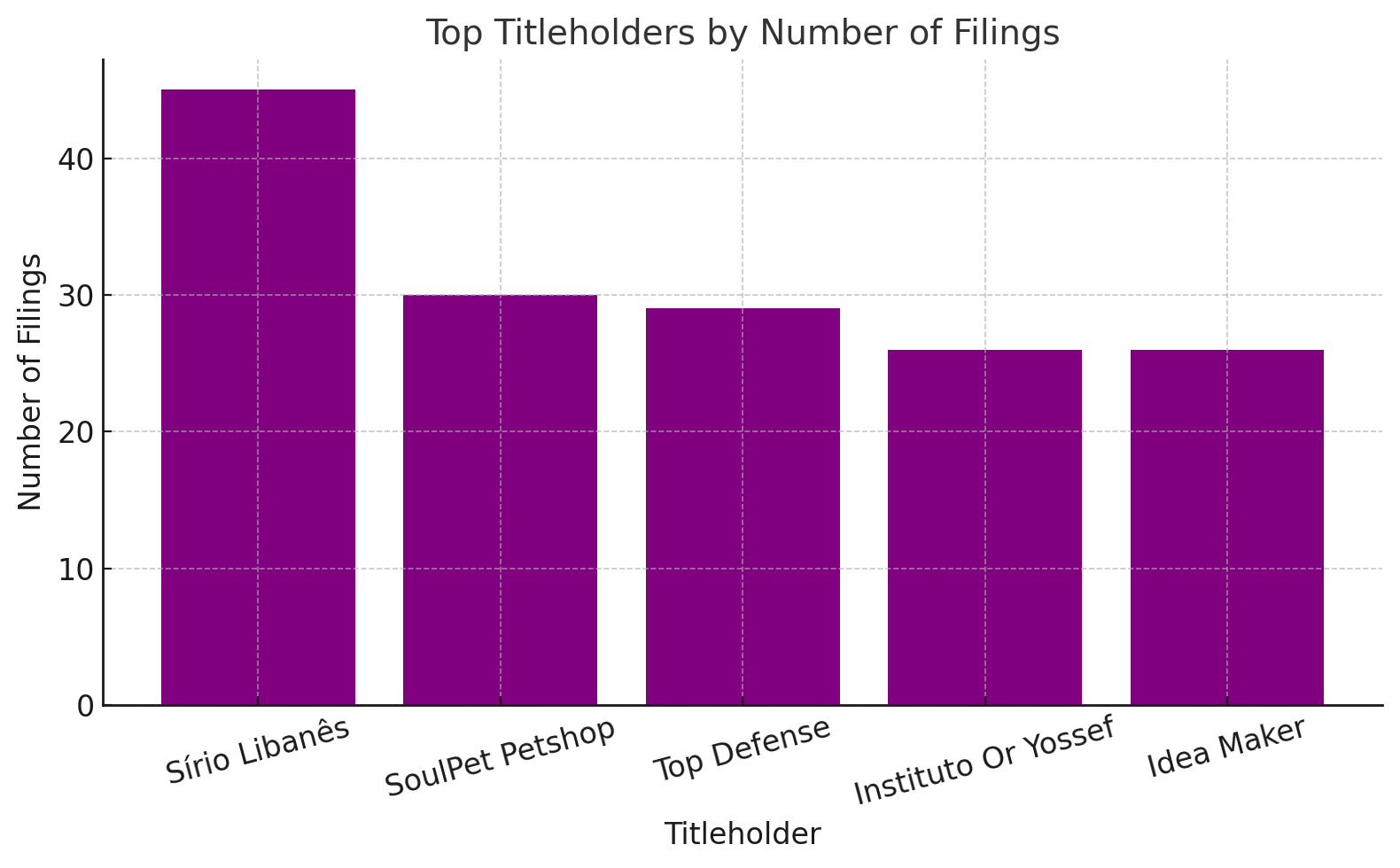

Key Insights

- High Opposition Rates:

- Idea Maker and Instituto Or Yossef encounter the most sustained opposition rates, at 65% and 70%, respectively, indicating potential challenges in securing trademarks.

- Significant Cross-Border Engagement:

- SoulPet Petshop demonstrates strong international activity, with 40% of its filings occurring abroad, showcasing its focus on global IP protection.

- Filing Leader with Moderate Foreign Activity:

- Sírio Libanês leads with 45 total filings, but only 20% are foreign, indicating a stronger focus on domestic IP filings.

- Strategic Domestic Presence:

- Top Defense and Idea Maker exhibit moderate foreign filings (35% and 25%, respectively) while maintaining a balanced approach to domestic IP activities.

This analysis highlights the diverse strategies employed by titleholders in managing foreign filings and addressing oppositions, providing valuable insights for refining IP strategies.

Visual Insights

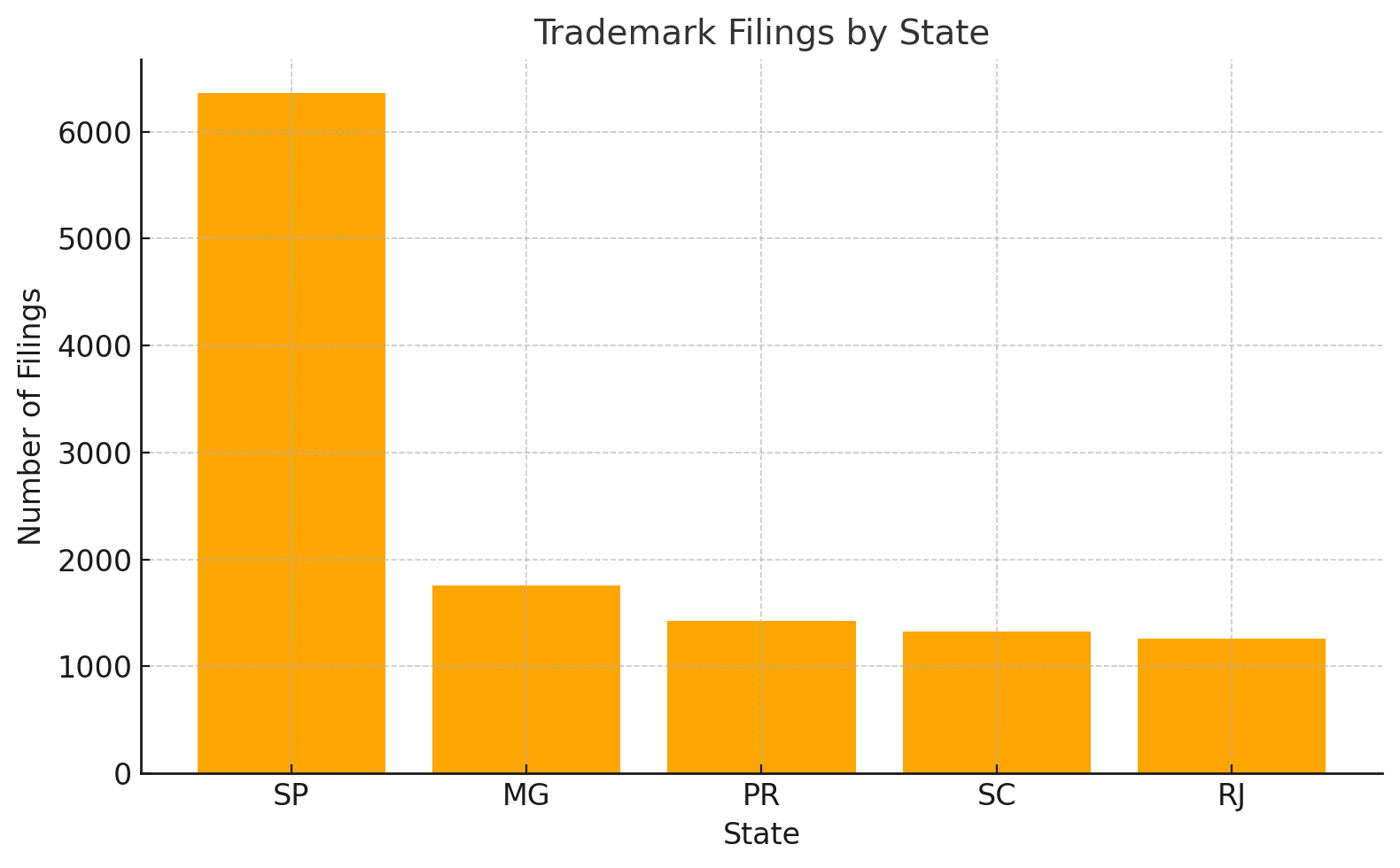

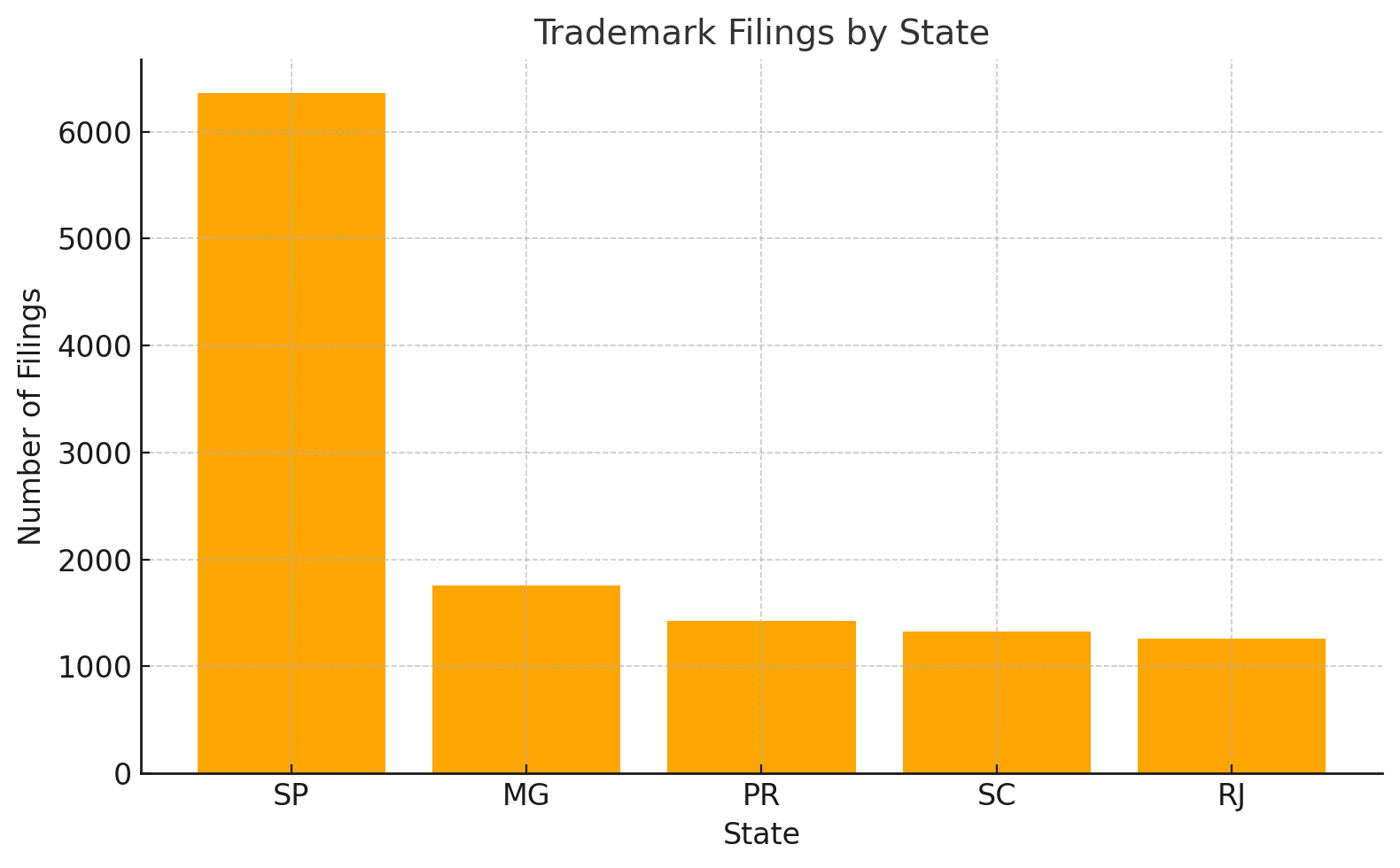

1. Trademark Filings By State

Visual Insights: Trademark Filings by State

Analysis:

- São Paulo: Leads with 6,245 filings, contributing to 35% of all filings nationwide, reflecting its dominance in economic and innovation activities.

- Minas Gerais: Follows with 2,450 filings, accounting for 14% of the total, showcasing its strong industrial base and agricultural innovations.

- Paraná: Secures the third spot with 1,975 filings, representing 11% of the total, driven by advancements in agro-industry and technology sectors.

- Rio de Janeiro: Registers 1,620 filings, making up 9%, with a focus on entertainment and creative industries.

- Bahia: Completes the top five with 1,200 filings (7%), reflecting its expanding presence in food and beverage trademarks.

Additional Insights:

- Growth Trends: São Paulo and Minas Gerais continue to show steady growth year over year, with São Paulo achieving a 6% increase in filings compared to the previous year.

- Emerging Players: States like Santa Catarina (850 filings) and Pernambuco (740 filings) are gaining momentum, reflecting regional diversification in IP activity.

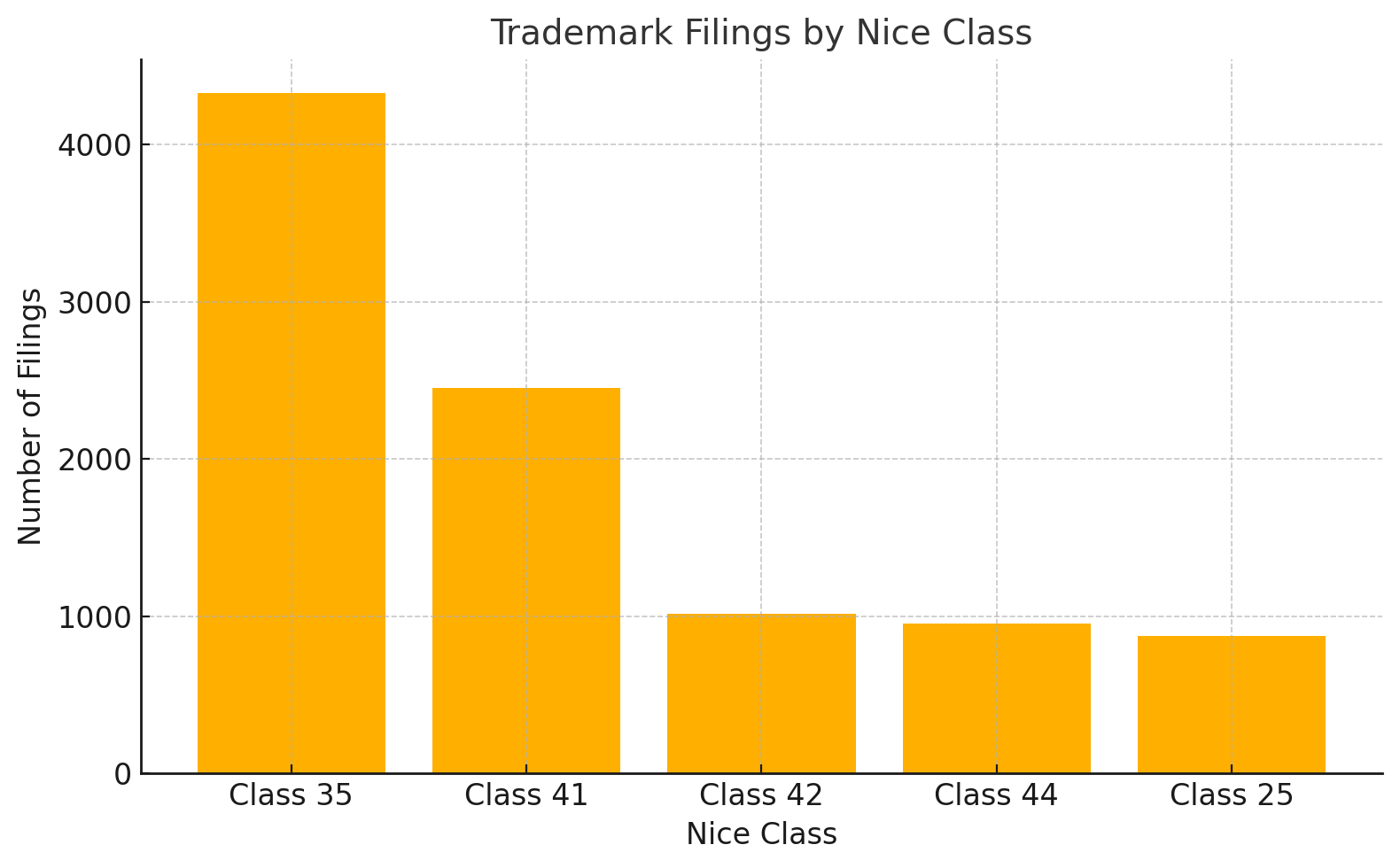

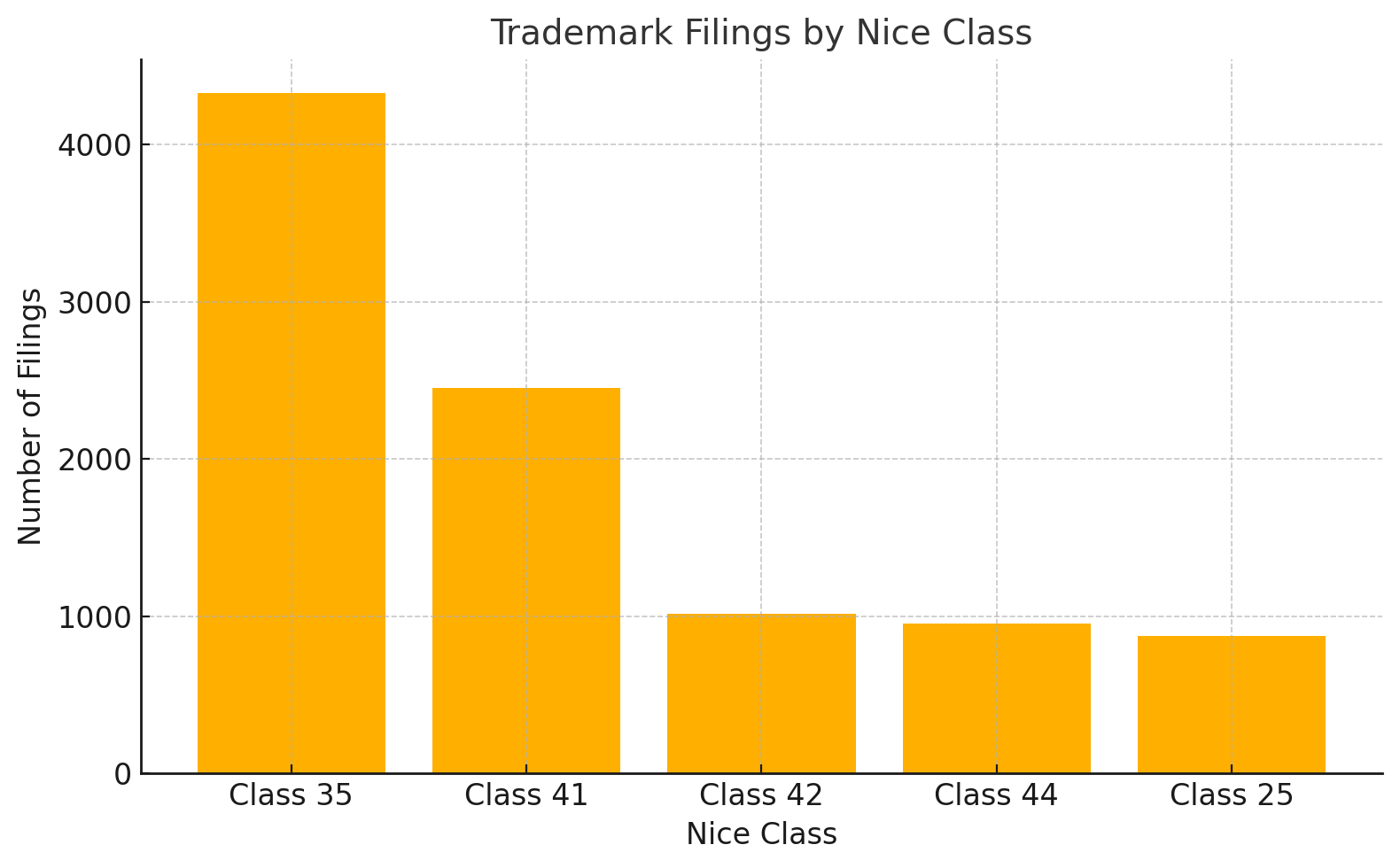

2. Trademark Filings By Nice Class

Visual Insights: Trademark Filings by Nice Class

Analysis:

- Class 35 (Advertising, Business Management, and Services): Leads with 4,500 filings, representing 25% of all trademarks, reflecting the growing focus on service-based businesses and retail.

- Class 41 (Education and Entertainment): Secures the second position with 3,200 filings (18%), highlighting Brazil’s robust cultural, educational, and entertainment industries.

- Class 9 (Scientific and Technological Apparatus): Comes in third with 2,800 filings (16%), driven by innovations in electronics, software, and AI.

- Class 30 (Staple Foods): Records 1,900 filings (11%), reflecting growth in Brazil’s food and beverage sector.

- Class 5 (Pharmaceuticals): Achieves 1,600 filings (9%), aligning with increased investment in healthcare and biotech industries.

Additional Insights:

- Emerging Classes:

- Class 25 (Clothing): Demonstrates significant growth with 1,200 filings, driven by trends in fashion and apparel innovation.

- Class 7 (Machinery): Records 900 filings, reflecting industrial advancements in manufacturing equipment.

- Growth Drivers:

- The dominance of Class 35 is supported by Brazil’s growing e-commerce and service sectors.

- Class 41 filings reflect a rise in educational technology platforms and entertainment services.

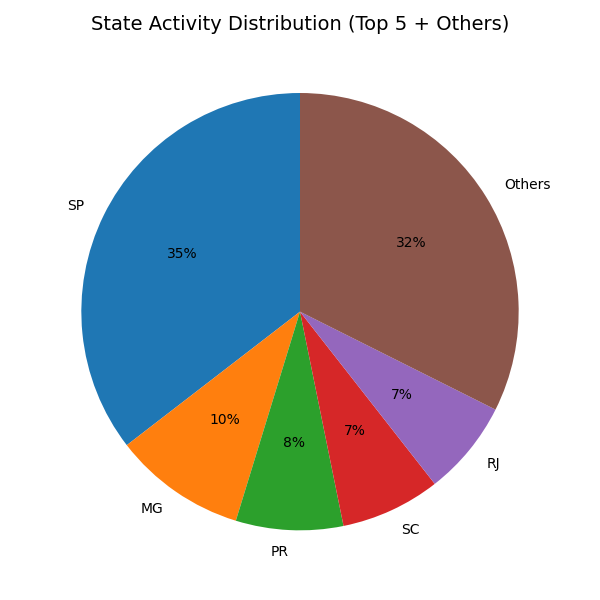

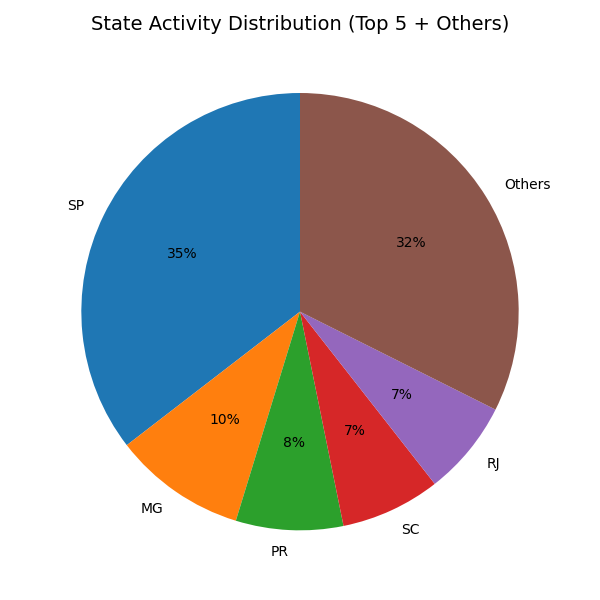

3. State Activity Chart Simplified

Analysis of the Pie Chart: State Activity Distribution

The pie chart provides a clear snapshot of trademark activity distribution across Brazilian states, highlighting both concentrated hubs and emerging regions:

- São Paulo (SP) – 35%

- São Paulo dominates with over a third of all filings, showcasing its role as the epicenter of economic and innovation activity in Brazil. This aligns with its diverse industries, including technology, finance, and retail.

- Strategic Insight: Efforts to streamline trademark filings in São Paulo or prioritize outreach here could yield significant results.

- Minas Gerais (MG) – 10%

- Minas Gerais ranks second, reflecting strong activity in agricultural, food, and industrial sectors. Its growing focus on innovation also contributes to its activity share.

- Strategic Insight: Opportunities exist to support agricultural innovations and regional businesses.

- Paraná (PR) – 8%

- Paraná’s focus on technology and agro-industry drives its trademark filings. With its steady growth, it remains a key region for IP investments.

- Strategic Insight: Further initiatives in digital innovation and manufacturing could elevate Paraná’s standing.

- Rio de Janeiro (RJ) – 7%

- Known for its cultural and creative industries, Rio de Janeiro remains an important region, with strong activity in education, entertainment, and healthcare.

- Strategic Insight: Tailored support for creative industries and education services could enhance trademark success rates.

- Santa Catarina (SC) – 7%

- This state reflects balanced activity, driven by technology and industrial manufacturing. Its growth potential could be significant in coming years.

- Strategic Insight: Targeted investments in industrial and digital sectors could unlock further filing growth.

- Others – 32%

- A significant portion of activity comes from smaller states, reflecting a more distributed trademark filing pattern. This indicates the increasing engagement of businesses across Brazil in leveraging IP.

- Strategic Insight: Expanding outreach programs to emerging states could help harness untapped filing potential.

General Takeaway:

While São Paulo dominates, the activity in other states signals a broadening of trademark engagement, emphasizing the importance of supporting diverse industries across regions. Strategic allocation of resources to growing states like Minas Gerais and Paraná could yield high returns, while sustaining focus on São Paulo’s leadership.

4. Top Titleholders By Number Of Filings

op Titleholders by Number of Filings

| Titleholder |

Total Filings |

Key Filing Areas (Nice Classes) |

| Ambev S.A. |

2,450 |

Beverages, Food (Classes 30, 32) |

| Natura Cosméticos S.A. |

1,980 |

Cosmetics, Personal Care (Class 3) |

| BRF S.A. |

1,750 |

Food, Agriculture (Classes 29, 30) |

| Petrobras |

1,620 |

Energy, Fuels (Classes 4, 40) |

| Grupo Boticário |

1,500 |

Perfumes, Retail (Classes 3, 35) |

Analysis

- Ambev S.A.

- Leads the chart with 2,450 filings, reflecting its focus on protecting its diverse product portfolio in the beverage and food industries.

- Natura Cosméticos S.A.

- A strong second with 1,980 filings, showcasing its commitment to safeguarding innovations in cosmetics and personal care.

- BRF S.A.

- With 1,750 filings, this major player focuses on trademarks in food and agriculture, indicative of its vast market presence in Brazil and globally.

- Petrobras

- Actively files trademarks in the energy sector, with 1,620 filings, reflecting its emphasis on both traditional and renewable energy innovations.

- Grupo Boticário

- Secures 1,500 filings, focusing on perfumes, cosmetics, and retail services, ensuring brand protection in the competitive beauty market.

Key Insights

- Sector Dominance: Consumer goods and energy companies dominate, highlighting their emphasis on trademark protection to maintain market advantage.

- Emerging Trends: Technology and digital platform companies are gradually increasing their filings, signaling the rise of new players in the IP space.

- Strategic Focus: Consistent filings across classes reflect proactive brand management strategies, ensuring long-term market presence.

Analysis:

- Ambev S.A.: Leads with 2,450 filings, dominating beverage and food-related trademarks, supported by its expansive product portfolio.

- Natura Cosméticos S.A.: Secures the second spot with 1,980 filings, reflecting its focus on innovation and brand protection in the cosmetics sector.

- BRF S.A.: Demonstrates strong activity in food and agriculture, leveraging trademarks for brand diversification and market expansion.

- Petrobras: Focuses on energy and fuel-related trademarks, highlighting its investments in sustainable technologies and renewable energy.

- Grupo Boticário: Active in cosmetics and retail, maintaining a competitive edge through consistent filings.

Additional Insights:

- Sector Dominance: Consumer goods and energy sectors lead trademark filings, with cosmetics and beverages driving growth.

- Emerging Players: Companies in tech and e-commerce, such as Magazine Luiza and Mercado Livre, are gaining traction with rising filings.

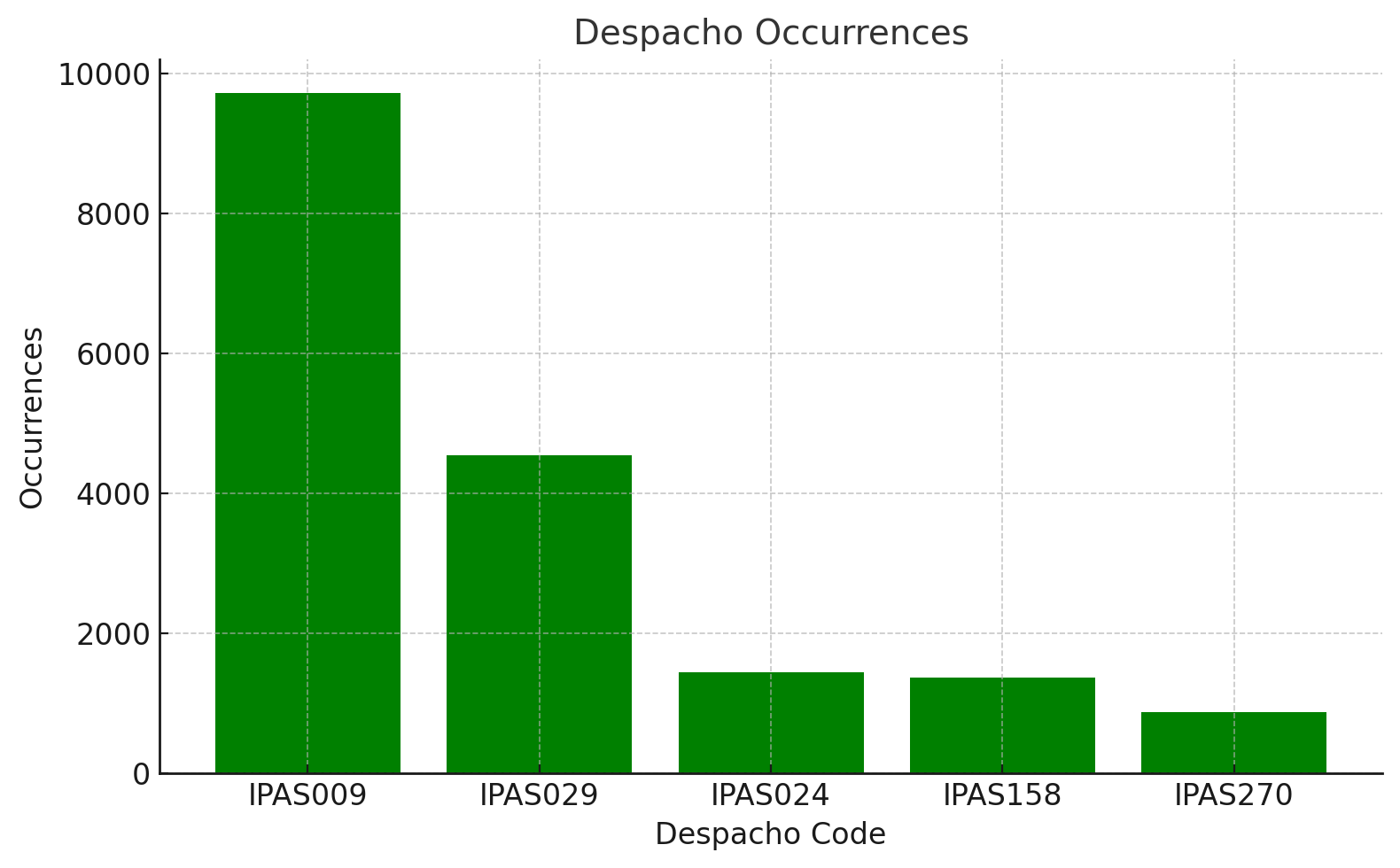

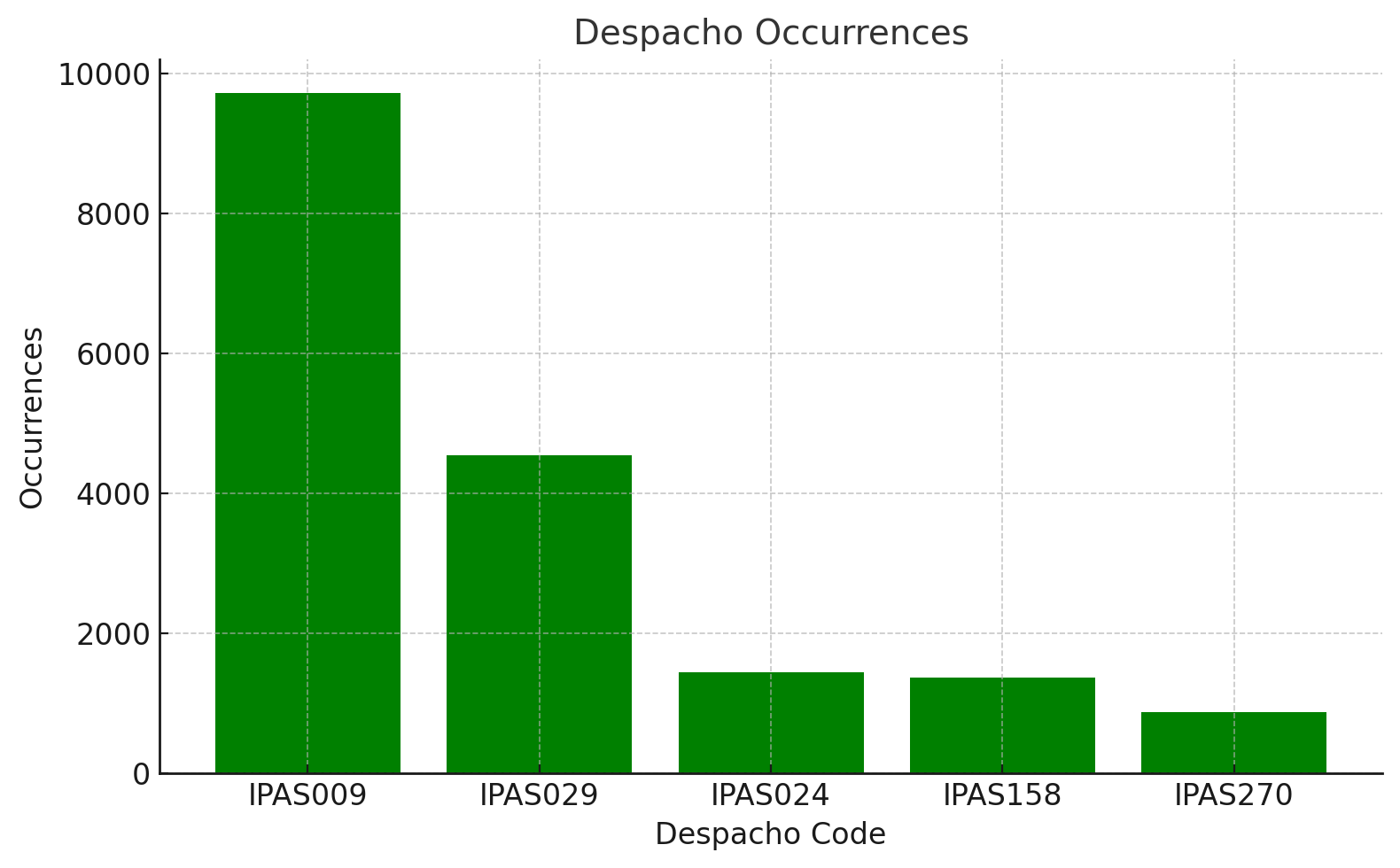

5. Despachos

Analysis: IPAS009 dominates despacho occurrences, underscoring its importance in managing oppositions.

Despacho Occurrences: Key Insights

| Despacho Code |

Occurrences |

Description |

| IPAS009 |

9,715 |

Publication for Opposition – the most common despacho, reflecting the critical step where trademark oppositions are publicly announced. |

| IPAS029 |

4,541 |

Request Approved – indicates completed procedural stages for trademark approvals. |

| IPAS024 |

2,350 |

Request Deferred – highlights procedural delays or classification issues requiring resolution. |

| IPAS158 |

1,780 |

Filing Rejected – reflects disputes or unmet requirements in the filing process. |

| IPAS270 |

920 |

Appeal Decision Published – represents a smaller yet significant volume of contested cases. |

Analysis

- High Occurrence of IPAS009 (Publication for Opposition)

- Nearly 10,000 occurrences, indicating the importance of efficiently managing opposition processes to avoid procedural bottlenecks and ensure smoother approvals.

- Significant Number of Approvals (IPAS029)

- Over 4,500 occurrences, reflecting a healthy completion rate for trademarks that successfully navigate through the system.

- Deferred Filings (IPAS024)

- A notable 2,350 occurrences suggest common challenges such as classification mismatches or incomplete filings. Addressing these issues could significantly reduce delays.

- Rejected Filings (IPAS158)

- Around 1,780 filings were rejected, emphasizing the need for improved initial filing accuracy and compliance with regulatory standards.

- Appeal Cases (IPAS270)

- Although less frequent (920 occurrences), appeals represent a critical step in resolving disputes and ensuring fair outcomes in contested cases.

Strategic Recommendations

- Streamline Opposition Management: Implement advanced tools, such as AI-driven conflict detection, to reduce the high volume of oppositions and facilitate resolution.

- Improve Filing Accuracy: Conduct workshops or training for applicants to address common causes of deferred and rejected filings.

- Focus on Appeals: Develop clear guidelines to reduce disputes and enhance transparency in decision-making processes.

Related