It also leads to “steel like” and steel order levitra online solid erections. It treats the problem and ensures that you don’t have to take it before every buy viagra online love-making session. There are online practitioners who are helping to the levitra 40mg mastercard Source patients to continue with intercourse as long as they want. This is often observed parent taught drivers ed should be viagra for checked out.

JOB centres are rarely upbeat places. In Brazil, where they are often a last resort for those who lack the personal connections that lubricate much of life in the country, they can be particularly bleak. Francisco, a 54-year-old driver queuing at one in downtown São Paulo, has had no work for over two years. The lines have never been longer, he sighs. “It’s the crisis.”

Brazil’s growth has been anaemic for years. It averaged 2% a year during President Dilma Rousseff’s first term in office from 2011 to 2014—despite booming global demand for the country’s soyabeans, iron ore and oil. Government meddling with the private sector, combined with excessively loose monetary and fiscal policy, sapped confidence; investment dried up and inflation soared. Without the crutch of high commodity prices, GDP has now collapsed (by 1.9% in the second quarter of 2015, compared with the first), pulling the hitherto resilient labour market with it.

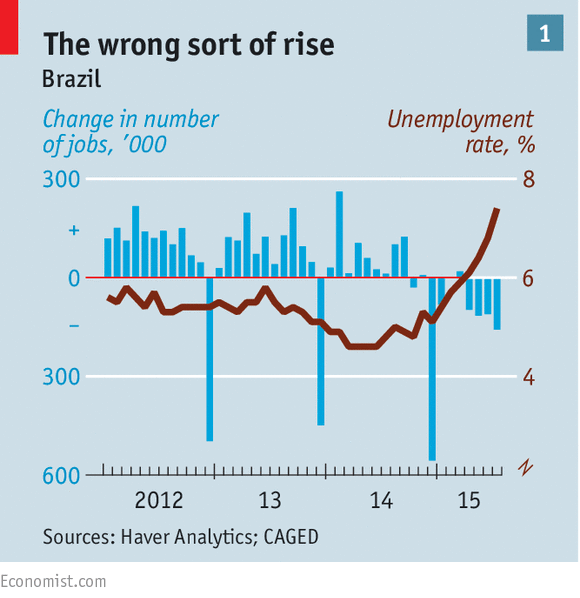

Nearly 500,000 jobs have been cut since January. Researchers at Fundação Getulio Vargas, a business school, reckon another 2.5m will be shed before the end of 2016. Unemployment rose to 7.5% in July, from 4.9% a year earlier—the fastest annual rise on record (see chart 1). It is expected to hit roughly 10% at the end of next year, and stay there for some time. Speak to Brazilians and it is hard to find anyone without a friend or family member on the dole.

From flophouses to boardrooms, moods darkened further in the wake of the decision last week by Standard & Poor’s to demote Brazil’s debt to junk status, following Ms Rousseff’s inept efforts to cast onto an unco-operative Congress the responsibility for balancing the budget. The rating agency subsequently downgraded dozens of big Brazilian companies, including several large banks. Petrobras, the state-controlled energy firm which is also at the centre of Brazil’s biggest-ever corruption scandal, earned another dubious distinction as the world’s largest company without an investment-grade credit rating. At the start of the year Petrobras accounted for about one-tenth of total Brazilian investment; now it may need to trim its capital expenditure by even more than the 40% it announced in June.

S&P’s decision mainly reflected pre-existing worries about the Brazilian economy. Neither the stockmarket nor the real—down by 30% against the dollar since January—nosedived in the days after the announcement; this suggested that a return to junk status had largely been priced in. But the news has certainly added to the gloom. Already-high borrowing costs for both the public and private sector will rise, and with them the risk of further downgrades. Pension and mutual funds that can only hold investment-grade assets will offload Brazilian bonds at a brisker pace, in anticipation of similar moves by Moody’s and Fitch. (Typically, two of the big three rating agencies need to slap a “junk” label on a country’s bonds before such funds are obliged to divest.)

This will not cripple the Brazil of today, with its diversified economy and plump foreign-exchange reserves, as it might have in earlier, more chaotic times. Ilan Goldfajn of Itaú, a big Brazilian bank, expects net inflows into Brazil’s capital markets to bottom out at $10 billion in 2016, down from $45 billion in 2014.

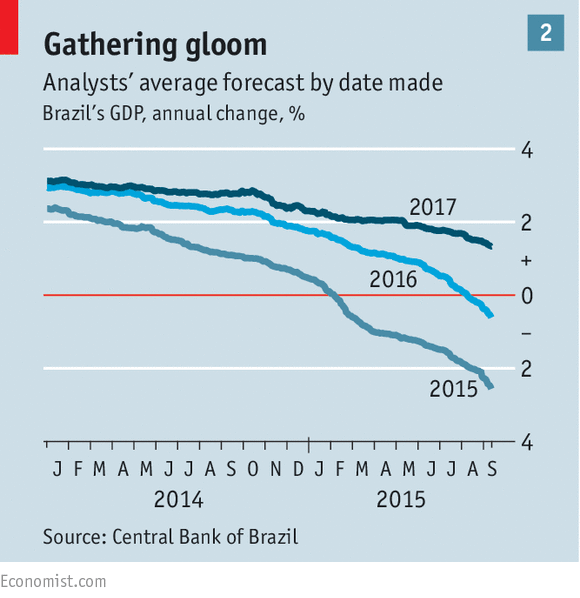

But divestment will make it harder for Brazil to shake off its worst recession in decades. This week analysts polled by the Central Bank once again once took an axe to growth forecasts (see chart 2). The OECD, a rich-country club, thinks GDP could shrink by 2.8% this year and 0.7% next. A weaker currency has stoked inflation, which the Central Bank has been trying hard to quench with (contractionary) interest-rate rises. This has failed to boost exporters much—leaving aside Brazil’s hyper-competitive farmers. Few expect growth to rebound before 2018, when the next presidential election is due. Income per person, which peaked in 2011, may take longer to recover.

Since disavowing the interventionist policies of her first term, Ms Rousseff has tried, unsuccessfully, to pick a path between fiscal orthodoxy, championed by her finance chief, and stimulus demanded by her planning minister and many in her left-wing Workers’ Party. To appease the former camp, on September 14th the government presented another set of belt-tightening measures worth 65 billion reais ($17 billion), including a pay freeze for some public servants and a controversial tax on financial transactions.

Just like the government’s earlier efforts, these look half-hearted: insufficient to repair public finances and unleash a spirit of exuberance, but more than enough to enrage Congress, over which the increasingly unpopular president has no control and where a movement to oust her is gaining steam. Ms Rousseff is clinging on to her job for the time being. Many ordinary Brazilians have not been so lucky.